Financing

We invest to create capital for our work in solving complex societal challenges. We do this with a focus on responsibility and future generations.

Our distributions

Large portions of the profit we create go to the projects and collaborations into which we enter. A smaller portion of the profits we create goes to protect ourselves against inflation and unforeseen events. Our earnings follow the course of events in the world. So, of course, there will be fluctuations. By setting some earnings aside, we become a more stable collaborative partner.

In 2024, we distributed DKK 149.3 million: DKK 67.7 million to young people in vulnerable positions, and DKK 50.6 million to stage and visual arts projects, while DKK 31 million went to other purposes, including, among other things, the Crown Prince Couple’s Awards, Thoravej 29, and support for organisations that work for social development. In addition, we had internal distributions of DKK 1.5 million for our work with the rich, diverse nature in Svanninge Hills.

Database for grants

Foto: Tobias Nicolai

Responsible investments with profit

We invest in over 1000 companies exclusively through external investment managers, whom we choose with care. Our investments are in listed and unlisted shares and debentures, properties, industry, and in private equity funds and private debt funds. Most of our investments take place in the Nordic countries, northern Europe, and the US. Other OECD countries, Emerging Markets, Brazil, India, China, and Asia constitute a smaller portion of our investments.

We invest for the long term and accept liquidity and volatility risks in order to achieve a better result and the most means possible for our philanthropic work.

ESG policy for investments

It is important for us to be clear and transparent about how we invest.

Therefore, we have compiled our exclusion criteria, principles on active ownership, requirements for external managers, mission-driven investments, and monitoring of investment managers in an ESG policy for investments.

Our policy takes its starting point in the international standards for responsible corporate conduct from the OECD’s Guidelines for Multinational Enterprises and the UN Guiding Principles on Human Rights and Business. In addition, we support the Ten Principles of the UN Global Compact on responsible business conduct with respect to human rights, labour, environment, and anti-corruption.

Foto: Tobias Nicolai

Sustainability and investments

In order to engage more responsibly, we have a sustainability analysis done every quarter by an investment advisor Curo Capital, and each year we publish a report on the basis of these analyses.

In the analysis, our managers and companies are measured for how their investment portfolios affect climate, people, and society. We use the analysis to assess whether our investments are developing satisfactorily or whether there is a need to act. Sometimes, we sell off an investment. At other times, we enter into a dialogue with our investment manager in order to raise their ESG requirements. This is also known as active ownership.

Søren Kaare-Andersen, adm. directer, tells:

ESG risk reduced in 2024

The sustainability analysis from 2024 shows that our investment portfolio has generally developed in a positive direction. The ESG risk has been reduced and exposure to the oil and gas industry has fallen since last year. However, the analysis also shows that some investments have a negative outcome and require our attention. We are in dialogue with our investment managers about this.

Below, we link to the analysis in danish.

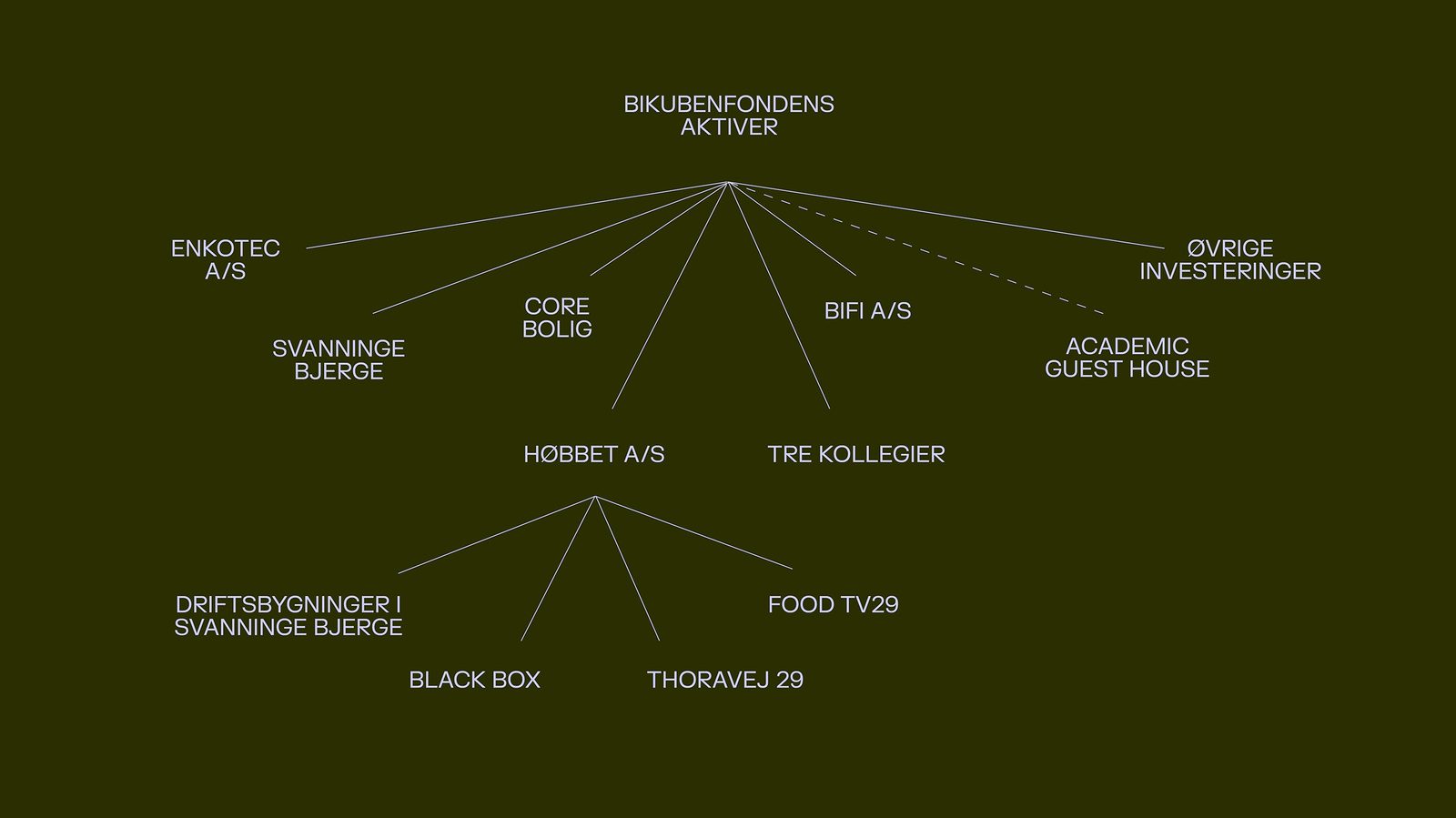

Assets

Enkotec

We own 100% of the industrial firm Enkotec A/S, whose head office is in Skanderborg. Enkotec develops and produces high-quality machines that produce machines for mass-producing nails. The construction industry from all over the world uses what Enkotec develops and produces. Enkotec A/S helps generate the economic profit that goes to our work resolving complex problems in society.

BIFI

The company BIFI A/S of which we own 100% runs our investments in a foreign Private Equity funds.

Høbbet

With Høbbet, we are working to create a sustainable and meaningful future through our engagement with agriculture and nature. Our goals are:

- To exploit and care for nature with respect to the environment and biodiversity

- To operate and develop agricultural enterprises with a focus on farming and livestock production

- To support charitable goals that create value for local society

- To own, lease, and administer real property with consideration and responsibility

We believe that agriculture can be more than production – it can be a driving force for community, management of natural resources, and sustainable development.

Svanninge Bjerge

Svanninge Bjerge is our 600-hectare nature preserve in southern Funen, which the Bikuben Foundation owns and runs. The preserve was originally a production forest; but, since 2016, we have worked to convert it into a wild forest in order to contribute to the development of more wild nature and more biodiversity. We also use the area for our Natur til et godt liv (Nature for a Good Life) project (link) in which nature is a space and a method for helping young people who, in one way or another, are in a vulnerable position in society.

Thoravej 29

In 2021, we purchased an older building of approximately 6400 m2 on Thoravej 29 in Copenhagen’s northwest quarter. We wanted to create a site where, together with people and organisations from different parts of society, we could work to create social change. In 2025, this became the home for the Thoravej 29 community, named after the address.

The building has been transformed from a principle that the building reuses itself and stands today as an example of how people may exploit many existing resources in reconstructions and renovations.

The Bikuben Foundation Group owns Thoravej 29. The primary tenants are Art Hub Copenhagen and the independent membership association, Thoravej 29. A café and restaurant are run at the address by the company Food TV29 along with a black box, run by the Bikuben Foundation Group.

The Bikuben student residences

Our three student residences in Odense, Aalborg, and Copenhagen offer students a home and a community for their studies.

10% of the rooms and apartments at the residences in Copenhagen and Odense are reserved for young people in vulnerable positions in society. Read more about the Bo-Sammen (Live-Together) project [link].

Originally, the Kollegiefonden Bikuben (the Bikuben Student Residences Foundation) was responsible for the erection and operation of our three student residences in Denmark. In 2019, the Bikuben Foundation and Kollegiefonden Bikuben merged.

Academic Guest House

The Academic Guest House is our student residence for Danish students who study in New York. Bikubenfoundation New York Inc. was established in 2003 and today runs the Academic Guest House.