Annual Report 2018

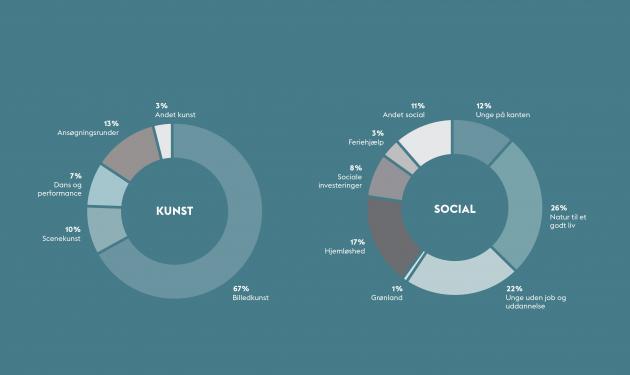

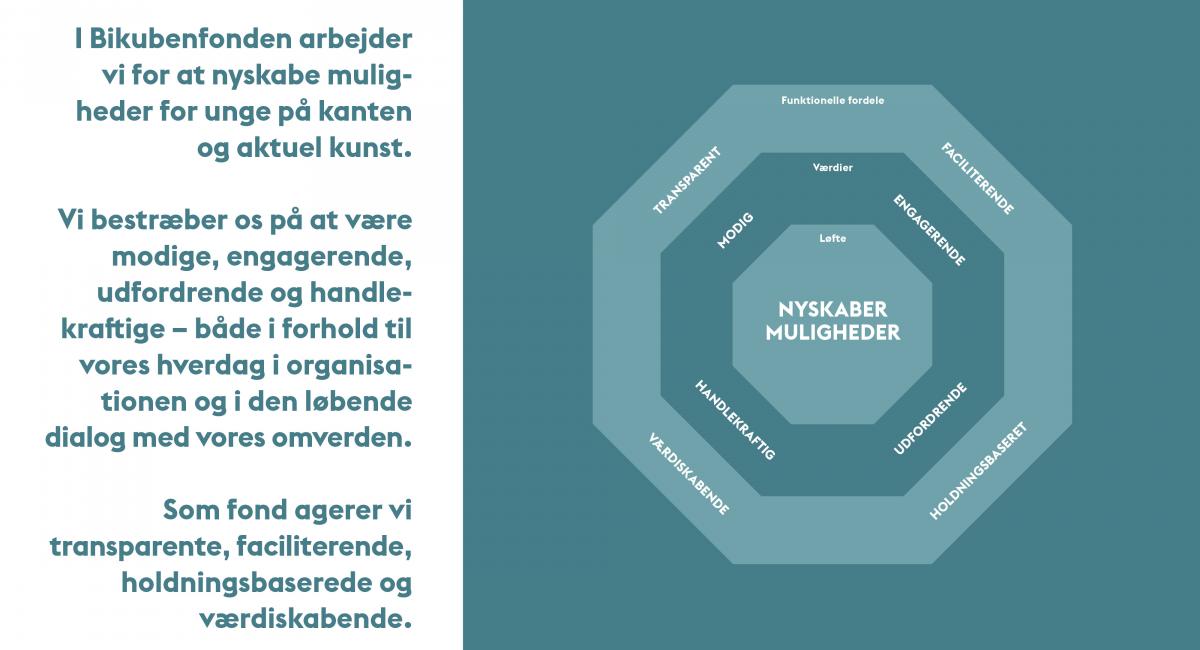

The Bikuben Foundation seeks to create new opportunities in two specific areas. Within the social area, our focus is on young people aged 13 to 30 years, who are facing complex social challenges. Within the arts, our focus is on the performing and visual arts, in an effort to create new opportunities for professional artists and cultural institutions. Within the arts, we launch research studies and initiatives where we see an opportunity for promoting the field, as exemplified by Art Hub Copenhagen, which was fully realised in 2018.

Art Hub Copenhagen – an internationally leading meeting place in Copenhagen

In 2016 we undertook a large-scale study of the conditions of the visual arts in Denmark, aimed at uncovering the challenges facing them and revealing the potential for developing the field. Among the recommendations from the study was the creation of a physical venue with the potential for promoting cross-disciplinary collaboration. The report also pointed to the need for enhancing international contact and networking. Since then, we have engaged in workshops and dialogues with artists, art institutions, foundations, and other actors in and around the Danish art scene, aimed at specifying scenarios for the content, structure and organisation of such a venue. One manifestation of this effort is Art Hub Copenhagen: a vision for an internationally leading venue in Copenhagen, an innovative setting for contemporary art and a meeting place where cross-disciplinary collaboration and an international outlook are placed centre stage.

In the summer of 2018, Art Hub Copenhagen was established as an independent association with Tine Fischer (director and founder of CPH:DOX) as the chair of the board. In early 2019, the hub moved into a temporary setting made available by the City of Copenhagen for the start-up period. From this platform the development is continuing, and activities involving Danish and international partners will soon be initiated. The Bikuben Foundation is committed to supporting Art Hub Copenhagen for a five-year period, with an initial three-year grant of DKK 26 million. The Novo Nordisk Foundation is also offering start-up support with a grant of DKK 2 million for developing and implementing Art Hub Copenhagen’s Centre for Artistic Research. Further, we are engaged in a dialogue with the Spanish foundation La Caixa to develop a common international programme. It is crucial that a comprehensive and long-term initiative such as Art Hub Copenhagen relies on multiple partners. Therefore, we are very appreciative of the start-up support from the City of Copenhagen and the Novo Nordisk Foundation, and of the commitment of La Caixa to add the international perspective that is essential for the success of Art Hub Copenhagen as a venue for artistic development. One of the Bikuben Foundation’s criteria for success is to contribute to the establishment of these types of partnerships.

The collaboration with La Caixa was established as an extension of our participation in the European cultural network under the European Foundation Centre. The opportunity for establishing contacts such as these is one reason why we place such a high priority on taking part in international networks.

I 2018 bevilligede vi i alt 76 mio. kr. til filantropiske formål. Pengene fordelte sig på 43 mio. kr. til aktuel scene- og billedkunst, 30 mio. kr. til unge på kanten og 3 mio. kr. til andre formål. Heraf har der været en tilbageførsel på 3 mio. kr., hvilket giver en nettouddeling på 73 mio. kr.

Saying farewell to a flagship

While we have launched a new ship in the visual arts area, we have also said farewell to an old flagship within the performing arts. In 2018, after a thorough evaluation of Årets Reumert (the annual Reumert Award), we decided that the Bikuben Foundation should not continue to fund the award that was established by the foundation 20 years ago. The decision was based on the rationale that if we are to accomplish our vision of generating innovation in the field of performing arts we will have to discard any initiatives that do not contribute to innovation.

The evaluation of Årets Reumert found that the award serves as a stamp of approval for both performances and performing artists, but that it lacks the focus on innovation and development that is key to the work of the Bikuben Foundation. When we made the announcement, we encouraged other organisations to continue the award, and that invitation has since been taken up by others in the industry.

Saying farewell to Årets Reumert by no means signals a departure from the performing arts. The Bikuben Foundation’s commitment to the field will continue undiminished. Among other initiatives, in 2018 we gave the dance theatre Bora Bora a four-year grant totalling DKK 3. 1 million. In 2018–2022 Bora Bora will host 35 international residencies for talented choreographers or people from the theatre with strong choreographic visions. Further, three of these residents will have works realised in co-productions with Danish venues and theatres.

In the near future, we will be gathering knowledge and mapping challenges and potentials to identify other areas within the performing arts where we can make a difference.

Enhancing the conversation about art

In 2018 we also developed our debate salons, which cover both the performing and visual arts. The salons aim to promote a qualified debate, highlight innovative artists, and contribute to the conversation about the significance of art in society. In 2019 we will introduce new salon formats and boost promotion of the salons through the introduction of podcasts and videos.

––––––––––––––––––––––––––––––

How can we improve young people’s coping skills?

In 2018 we heightened our focus on young people on the edge. In the spring, we published a discussion paper on how to develop new initiatives directed at them. The paper argued that young people’s coping skills need to be supported and strengthened to enable them to move away from the edges of society. Our philanthropic actives in the social sector will focus on supporting initiatives that aim to build young people’s coping skills. These include the ability to deal with the many demands, challenges and decisions that are part of becoming an adult, such as paying one’s bills on time, getting up in the morning, and maintaining a home. It also includes setting goals and following through, meeting the demands of the workplace and building and maintaining relationships with others. It means thinking and acting in a way that makes it possible to live the life one desires.

In 2018 we earmarked DKK 30 million for new social concepts aimed at enhancing marginalised young people’s coping skills and bringing them closer to finding a job and completing an education. We also invited other actors in the social field to submit applications for the initiative we are calling Young People on the Edge Without a Job or Education. For this initiative, we sought to rethink the application process: instead of calling for solutions, we encouraged actors from across the field to get together to define and refine their understanding of the core issues. We also asked them to rethink their efforts and collaborate around concepts rather than proposing individual projects.

We received a total of 94 applications from municipalities, and private and civil-society actors. Seven applications were advanced to round two, each receiving DKK 200,000 to develop their initial concepts further. We hosted a one-day development event for these selected applicants. At that event they received feedback on their concept from advisors with expertise in social innovation and from young ‘end-users’ from the City of Copenhagen’s Youth Panel. It was essential for us to incorporate young people’s own thoughts, dreams and desires for their own lives in the development of the proposals. Without their perspectives we cannot arrive at solutions that are relevant to the young people themselves.

What did we learn?

In an effort to improve transparency we chose to share our experiences from this application round. We commissioned an analysis of the process to identify trends regarding issues, partnership constellations and themes in the proposals. We also asked the applicants to evaluate our new application process to help us understand where we succeeded, and what we might do better in the future. Among other findings, the analysis concluded that the application round led to more and new partnership constellations, and that these constellations often included state and municipal actors, which we consider a new and positive development. We also found that a call of this type places high demands on the applicants, ones that may be difficult for some organisations to meet. We will bear this in mind in the future.

We consider this transparency to be crucial for the way we want to act as a foundation – with accountability and responsiveness. This kind of application round offers an opportunity to give knowledge back to the actors that are involved, identify blind spots and adapt how we collaborate in the social field.

In April 2019 we will select three of the seven second-round concepts, with each receiving a grant of up to DKK 10 million.

Developing nature-based social interventions

The social work taking place in the Bikuben Foundation’s nature resort in Svanninge Bjerge on the Danish island of Funen has also undergone significant development in recent years. Together with the University of Copenhagen we mapped the existing knowledge of nature-based social interventions in a report entitled “What Do We Know About At-Risk Youth and Nature-based Social Interventions in Nature?” The report forms the basis of Natur til et godt liv LAB (Nature, the Key to a Good Life LAB), a programme that we initiated together with the University of Copenhagen. In our next step, we will team up with selected partners to develop nature-based social interventions for at-risk youth further, with Svanninge Bjerge as an important setting for developing and testing methods for enhancing young people’s life-coping skills.

Svanninge Bjerge transitions to natural woodland

The way in which we manage Svanninge Bjerge has also undergone development. Since 2016 we have been transitioning if from a managed to a natural woodland. The purpose of this transition is to increase biodiversity, a goal that goes hand in hand with the goal of providing better experiences as a result of greater natural variation. Over the past six months we have hosted and attended a number of events to share our practical experiences from the conversion to natural woodland with scientists, forest managers and other relevant actors.

The excellent conditions for developing rich and varied wildlife and vegetation in the area were highlighted when Svanninge Bjerge, along with the neighbouring area Svanninge Bakker, was included in Denmark’s new Nature Canon in 2018.

––––––––––––––––––––––––––––––

Merger and new board members

Internally, in addition to introducing new IT systems, we have been exploring the merger of Kollegiefonden Bikuben (the Bikuben Foundation for student halls of residence) and the Bikuben Foundation into a single new foundation. This would allow us to maximize resource efficiency and minimise administration costs, making the operation more agile and thus, ultimately, able to allocate more to grants. We plan to make a decision on the potential merger in 2019.

In 2018 we said goodbye to two board members. As part of a planned generational transition, Søren Jenstrup and Jon Stokholm stepped down from the board after years of dedicated service. Jenstrup and Stokholm had served on the board since 2010 and 2011, respectively, and have both put considerable effort into implementing the Bikuben Foundation’s current strategy, which was adopted in 2015. In their place, we welcomed Mads Roke Clausen and Marie Nipper. As director of Copenhagen Contemporary and former head curator of ARoS in Aarhus and Tate Liverpool, Marie Nipper has first-hand knowledge of both Danish and international cultural institutions, and as an art historian she possesses expertise in the area of visual arts. Mads Roke Clausen, who is the former director of the Danish charity Mødrehjælpen (Mother’s Aid) and the current chairman of the National Council for Volunteering, has broad insight into the social area. Further, as a PhD Fellow at Roskilde University Mads Roke Clausen has considerable insight into social investments – an area in which the Bikuben Foundation has also been engaged in recent years.

A reasonably successful financial year

In financial terms, 2018 was reasonably successful for the Bikuben Foundation, given trends in the securities market. Our company Enkotec also did well, ending the year with a decent result despite talk of tariffs in the United States, which put a damper on the international nail market.

Our earnings will always rely on events in the outside world, however, our portfolio is designed with long-term earnings in mind. Over the years we have reduced the share of listed bonds and shares in our portfolio in favour of investments in private equity funds, which produce a superior yield, enabling us to maintain stable, reasonably high returns over time.

This investment strategy is crucial to our philanthropic work, as we increasingly award large grants with a long lifespan. This requires us to maintain a liquidity buffer to be able to meet our commitments. In recent years we have awarded larger and longer-term grants than before, thus making bigger payments than in previous years. In the coming years, our distribution figures will continue to develop differently than they have in the past.

This development is a natural result of our strategy, which involves deliberately choosing initiatives with a long timeline. This enables the foundation to take a long-term view and help to fund initiatives and concepts that have great potential but whose real impact may take years to materialise.

The Bikuben Foundation is a commercially operating foundation that owns certain assets, which are operated with various purposes in mind. The company Enkotec A/S helps generate the financial earnings to fund the Bikuben Foundation’s philanthropic work. Svanninge Bjerge is a nature area that the Bikuben Foundation operates with a view to conserving the area’s unique character and which we also use for social initiatives. The main purpose of the Bikuben Foundation’s student halls of residence is to offer students a good base during their studies, but they, too, are used in our social work.

The Bikuben Foundation is an active part of society, both through our grants for social and artistic purposes and through our other activities. The United Nations’ global Sustainable Development Goals provide a framework for promoting a sustainable society. The Bikuben Foundation is committed to monitoring and identifying how our activities contribute or may come to contribute, at various levels, to this development. For example, our effort to transition the Svanninge Bjerge area to natural woodland relates specifically to Sustainable Development Goal no. 15: 'Protect, restore and promote sustainable use of terrestrial ecosystems (...) and halt biodiversity loss.' Our student halls of residence play a role in our efforts to combat homelessness, giving young people improved conditions for completing an education, which relates to Goal no. 4: ‘Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all.’ In 2019 we are going to intensify our efforts in pursuing the global Sustainable Development Goals.

SVANNINGE BJERGE

Svanninge Bjerge is a 600-hectare nature area on the Danish island of Funen that is owned and operated by the Bikuben Foundation.

The Bikuben Foundation acquired the area in 2005, with the purpose of conserving the area’s unique nature and landscape to optimise conditions for the area’s animal and plant life, to benefit current and future generations. The area is open to anyone wishing to enjoy the natural diversity and experience the unique landscape, which offers beautiful views of the archipelago and the mainland. Svanninge Bjerge is a destination that is visited by more than 30,000 people a year. In 2018, along with the nearby Svanninge Bakker, it was included in Denmark’s new Nature Canon.

Using nature for social purposes

Since 2005 we have used Svanninge Bjerge as a setting for providing experiences of nature, and in recent years we have increased our focus on the potential of nature and outdoor experiences to help persons who are socially marginalised. This has led to the initiative Natur til et godt liv for young people on the edge. Together with selected partners we develop nature-based social interventions for at-risk youth, and Svanninge Bjerge offers an important base for developing and testing methods aimed at enhancing young people’s life coping skills.

Natural woodland in Svanninge Bjerge

In 2016 we embarked on an ambitious transformation of a large section of the woodland from managed forest to natural woodland. This creates the conditions for increased biodiversity and, in turn, more rewarding nature experiences for everyone visiting the area. With this project we wish to contribute to the expansion of untouched nature and greater biodiversity in Denmark, thus promoting the national goal of ensuring more natural woodland, as well as the UN’s international goal of halting the loss of biodiversity. The development of natural woodland is monitored through observations of the number of species in selected organisms.

Svanninge Bjerge Research Station

We also make Svanninge Bjerge available for scientists and students from the University of Southern Denmark who are undertaking biological field studies. The university rents access to the Bikuben Foundation’s research station, which contains an auditorium, labs and overnight accommodation. Researchers and students at the university monitor the development of biodiversity in several areas in Svanninge Bjerge, which provides an important basis for our nature conservation efforts.

THE BIKUBEN FOUNDATION'S STUDENT HALLS OF RESIDENCE

For a number of years, the Bikuben Foundation has provided funds to Kollegiefonden Bikuben, which has allocated these funds to constructing and operating three student halls of residence around Denmark – in the cities of Odense, Aalborg and Copenhagen.

Kollegiefonden Bikuben was founded in 2001 with the purpose of offering students in the old Danish university cities access to contemporary lodging. In May 2004, the Bikuben Kollegiet in Odense was completed. It contains 88 modern flats in varying sizes and a range of communal facilities. Next, in 2006, Kollegiefonden Bikuben welcomed 115 young students to the Bikuben Kollegiet in Ørestad south of Copenhagen. And in 2008 the Bikuben Kollegiet in Aalborg, with a total of 64 flats, was completed. In 2018 we began exploring a merger between the Bikuben Foundation and Kollegiefonden Bikuben, to form a new fund that would allow us to use our resources as efficiently as possible and minimise administration costs.

Sustainability is a key factor in the operation of our halls of residence, in which we choose energy-efficient and durable solutions. In 2018, the halls were retrofitted with intelligent lighting systems that switch off automatically and which were chosen for their energy-efficient properties.

Another key concern in relation to the halls is social sustainability. Thus, we allocate a number of flats to young people on the edge, offering them a chance to get back on their feet and be part of the community. With this policy, we aim to contribute to a culture of reciprocity, mutual engagement and inclusion, and to build the basis for a sustainable society. This initiative is part of the Bikuben Foundation’s goal of ending homelessness among young people. As part of The Alliance, A Home for All, we strive to create homes for young homeless people by putting homelessness on the agenda and developing new housing solutions that involve social support and inclusion in a community with other young people. We initiated the Hall of residence model, which is featured in the handbook Nyt, sammen, bedre (New, together, better) about innovative partnerships in the public sector.

ACADEMIC GUEST HOUSE

Like Kollegiefonden Bikuben, Bikubenfoundation New York, Inc. is an offshoot of the Bikuben Foundation. The American foundation was established in 2003, and two years later it acquired a 1300-m2 property with the intention of establishing a hall of residence for Danish students studying in New York City. This Academic Guest House opened on 1 January 2008. It is situated on Manhattan’s Upper West Side, close to Central Park, and accommodates 22 students in 12 flats. To apply for accommodation at the Academic Guest House, a Danish student or scholar must have a formal agreement with an educational institution in New York City or with private educators offering master classes.

New York welcomes large numbers of Danish students, scholars and persons seeking continuing training, whom the Bikuben Foundation wishes to provide optimal working conditions in a city where housing is in short supply.

FONDENES HUS (HOUSE OF FOUNDATIONS)

In early 2013, the Bikuben Foundation acquired Fondenes Hus, at no. 5, Otto Mønsteds Gade in central Copenhagen, with the purpose of promoting knowledge-sharing, competence development and cooperation among foundations, reaping the benefits of shared facilities and increasing transparency concerning the work of the foundations.

After some turnover in recent years, Fondenes Hus, in addition to housing the Bikuben Foundation, is now home to Bevica Fonden, EGV Foundation, Helsefonden (Health Foundation), Vanførefonden (Danish Disability Foundation), Labour Market Holiday Fund, BRFfonden and BRFholding A/S, Soldaterlegatet (The Soldiers' Grant), Forsikringsforbundet (Insurance Union) and Mind Your Own Business.

The day-to-day operation of Fondenes Hus places a high priority on promoting environmentally sustainable features. To reduce energy consumption, we installed intelligent lighting throughout the building in 2018 as well as intelligent heating and ventilation. We have also begun the installation of district heating.

ENKOTEC A/S

Enkotec A/S is a company that is fully owned by the Bikuben Foundation. Since 2006, when the Bikuben Foundation assumed ownership of the company as part of its investment portfolio, the company’s earnings have gone entirely to fund the Bikuben Foundation’s philanthropic work.

The company is the world’s leading supplier of machines for making high-precision nails. For more than 35 years, Enkotec A/S has been developing and refining machines for mass-producing high-precision nails for the building industry. Enkotec’s machines are designed to produce nails in very high quantities to keep unit costs down while maintaining top quality. Moreover, the machines are more energy-efficient and less noisy than competing products on the market. Thanks to a special technology, the machines do not require lubrication, like other machines, which makes them more eco-friendly. Environmental issues are generally a high priority to Enkotec A/S, and on 1 January 2018 the company switched to 100% green energy. It has also introduced a system for sorting used packaging and paper.

In recent years, Enkotec A/S has engaged in developing IoT (Internet of Things) solutions. Data generated by their machines enable the client to anticipate maintenance needs. This lets the client plan servicing to optimise operations and avoid down-time. This leads to more efficient production wherever the client is located in the world. It has also developed a new model that allows clients to lease machines.

Enkotec A/S holds its suppliers to high standards, with regard to both manufacturing quality and corporate social responsibility (CSR). Thus, all suppliers have to live up to Enkotec A/S’s Supplier Code of Conduct, which complies with the UN’s Supplier Code of Conduct.

Corporate development

Enkotec A/S began as a PhD development project in 1981 at NKT’s nail factory in Middelfart. In 1986 Enkotec A/S was established as an independent company and relocated to Skanderborg, where it is still headquartered today. Since acquiring the company, the Bikuben Foundation has been determined to keep production in Denmark. Since its acquisition by the Bikuben Foundation, the company has quadrupled in size.

Today, Enkotec A/S has 60 employees and about two-thirds of the global market for high-quality nails. In addition to its headquarter in Skanderborg, the company has an office in the United States and six other agencies throughout the world, covering the global market. More than 750 of Enkotec’s nail production machines are found in 45 countries worldwide.

Our financial strategy – the economic basis for the foundation’s donations

The Bikuben Foundation’s financial strategy aims to maximise the return on our investments, given the chosen risk profile. The return on investment is the economic basis for the foundation’s work. Our grants apply a long-term perspective, and the the foundation’s investments are designed accordingly.

In addition to the long-term focus, our financial strategy embraces liquidity and volatility risks in return for higher yields. We are able to do this because our grant strategy does not need to accommodate sudden or unanticipated payments, as it is based on stable payments over time. However, the strategy does require substantial funds. Hence, we opt for asset categories that are expected to produce high and moderately stable returns. Naturally, we also aim to ensure that our funds are managed in a professional, reliable and cost-efficient manner.

We invest in both listed and unlisted shares and bonds, property, industry, private equity funds and private debt funds and have few derivative financial instruments.

We place a high priority on generating positive absolute returns to ensure funds for the foundation’s philanthropic focus areas.

Long-term investment approach

Our investments take a long-term approach and are therefore fairly unaffected by short-term market fluctuations. To limit risk, our investments are diversified geographically and across industries. In recent years, disruption and political stability have moved further to the forefront of our considerations.

The bulk of our investments are in Northern Europe, the economically developed parts of Central and Southern Europe and the United States. Other OECD countries, emerging markets, the BRIC countries and Asia account for a fairly small share of our investment portfolio. Denmark is also not a major investment area for the foundation.

Dynamic investment approach

Our investment approach is essentially macroeconomic with an international outlook. We are a part of the surrounding society and we live on and with the opportunities this affords us. As much as possible, we seek to adapt our investments to the economic conditions. In 2018 we adapted completely to the low-interest-rate society and the resulting lack of potential in government bonds and nearby markets, including the real estate market, as well as reduced inflation and growth rates.

Consequently, we transitioned to bonds with various forms of credit built in and also replaced fixed-rate bonds with variable-rate ones. Private debt, one of the new asset categories, is playing an increasingly visible role in our investments.

This strategy is not risk-free, however the alternative could have been near-zero or even negative returns. The strategic emphasis on funds has proved to be robust in times of both prosperity and recession. This, too, should be viewed in light of the substantial absolute returns we need to realize the goals of the Bikuben Foundation.

Despite turmoil in many countries, market conditions in large parts of Europe and the United States and in the Far East have remained fairly favourable. However, trade wars, Brexit and the widespread aversion to globalisation are also part of the picture. Many companies in the areas in which we invest have had decent earnings, although listed companies have suffered under a general sense of pessimism in the market.

In recent years, many economies have faced low or even negative interest rates with little expectation of any real change in rates over the coming years. The Bikuben Foundation’s investment strategy has been planned accordingly, with a low exposure to bonds and, consequently, a higher exposure to private markets.

Investment partners

We make some investments ourselves, some in cooperation with banks, stockbrokers, private market houses and some via larger investment managers. In selecting partners we aim for long-term relationships, looking for partners with a strong track record, stable organisation and a capacity for innovation in a changing world. We devote considerable time to the selection of partners and to our ongoing dialogue with them. As a relatively small investor, the Bikuben Foundation needs to be nimble in order to secure a share of the attractive investments in the large houses around the world.

A note on private equity and private debt funds

Our commitment to invest in private equity and private debt funds is a long-term obligation, extending many years into the future. Hence, it is our policy to select private equity and private debt funds that have a history that convincingly demonstrates the capacity to manage large funds over a long-term period, including throughout the business cycle. They should further demonstrate a level of quality in their investment activity that ensures a good general performance, and they must live up to ESG (Environmental, Social and Corporate Governance) principles.

By systematically and persistently monitoring the funds, we acquire unique knowledge about which funds to invest in next.

The Bikuben Foundation invests in one to three new funds every year. The interval depends on the rate of return from existing investments. This lets us maintain a fairly constant level of capital that needs to be tied up. It also reduces vintage risk, the risk that one specific year turns out to be bad for investments and prices.

So far, our investment activity has been aimed at general funds – that is, funds with a diverse industry profile – with broad investments in medium-sized companies. We have no expertise in funds that invest in specific sectors, have a venture character or are geographically concentrated. To ensure the right spread, including the right risk spread, those types of investment activities require far greater investments than our size allows.

Investing responsibly

Our investment profile contains a broad mix of listed and unlisted shares, listed and unlisted bonds, private equity and private debt.

In the investment area – given the size of the foundation – we are not capable of pursuing direct ownership, except for Enkotec A/S, which is fully owned by the Bikuben Foundation. Thus, we invest responsibly by making sure that the managers and funds we rely on have adopted, and adhere to, clear CSR policies.

Our emphasis on responsible investments is guided by the UN-sanctioned principles for responsible investments, the UN’s Global Compact, and the international conventions ratified by Denmark. Thus, we consider such issues as human rights, workers’ rights, the environment and anti-corruption when we invest, and ensure that our investments do not contribute to activities associated with non-conventional weapons.

In assessing potential investments and making commitments to our partners we consider relevant issues pertaining to the environment, climate, social issues and good corporate governance. We require our partners to observe these issues continuously.

The goal of our responsible investment strategy is to generate value for the Bikuben Foundation, based on the assumption that companies with a long-term and sustainable approach can be expected to outperform companies without such an approach. This also means that certain investment types and potential cooperation partners will be excluded from our investment universe.

Higher absolute returns

Since 2004, private equity funds have constituted an important investment area. The Bikuben Foundation is currently a part of 12 funds in addition to our engagement with private debt funds. We pursue this investment activity to be able to invest in unlisted small and medium-sized companies that show good growth and earnings. This is also a good match for our portfolio of listed shares, mainly Blue Chip companies. These are characterised by greater fluctuations in price and a slightly displaced cycle in comparison to private equity companies.

Another important element is that the net returns from our private equity investments have substantially outperformed listed shares.

With regard to bonds, we have in recent years made a significant shift towards securities with an associated credit element. We have done this in order to shed the traditional portfolio of government and property bonds, due to their returns.

In recent years, property investments have replaced many of the poorest-performing bonds in our investment strategy.

Management

Our funds are handled by external managers and via our own resources. The figure below outlines the distribution. We cooperate with three Danish and four foreign private equity firms and others, two foreign private debt firms, two Danish investment firms and two more conventional Danish managers.

The figure below shows the individual elements by management form. We use a fairly simple format, which has shown good results in practice over the years.

Financial value creation in 2018

Financial value creation is a result of ideas and strategies that have been in use for a number of years. It was important for us to adopt a long-term approach characterised by discipline and agility in relation to the opportunities that emerge in the marketplace.

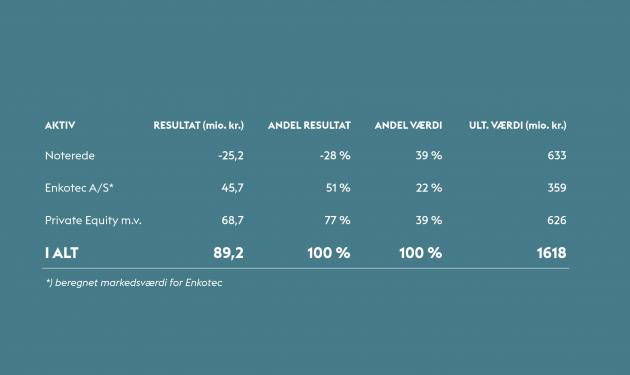

The Bikuben Foundation achieved a total investment result of DKK 89.5 million in 2018. This is a return of 5.5% compared to 11.2% in 2017. This result includes listed securities, private equity, private debt and Enkotec A/S, in which the Bikuben Foundation has a 100% stake. Given that 2018 was an exceedingly challenging investment year, we consider a return of 5.5% highly satisfactory.

In 2018 the foundation achieved a corporate result of DKK 73.1 million, compared to DKK 152.9 million the previous year. Of these earnings, DKK 73.0 million were allocated to philanthropic purposes, compared to DKK 113.8 million the previous year.

Costs at the parent foundation amounted to DKK 17.8 million, compared to DKK 14.0 million the previous year. Much of the increase stemmed from expenditures associated with the transition to the new IT systems. We gear our administration to maximise the value of the resources involved, for which the key cost figures are not adjusted.

Thus, key cost figures are just one among several efficiency indicators. Costs in per cent of grants remains low for the foundation, at 12.3%, the same level as last year. (In a longer-term perspective, however, it should be noted that the figures for 2014 were influenced by the legal requirement to allocate earmarked reserves for future grants. Without these reserves, the rate for 2014 would have been 16.4% compared to the official figure of 6.3%.)

In 2018 the foundation had an average full-time staff of 25. In connection with some of the awards, the foundation’s employees are actively involved in developing and operating the projects, and thus the associated labour costs are included in these grants. Employees working on the foundation’s own main initiatives in the social area and the arts – Svanninge Bjerge, with the initiative Natur til et godt liv, and Kollegiefonden Bikuben, with its Young People on the Edge initiative – accounted for 14 full-time positions on average in 2018. The net staff in 2018 was thus 11 full-time employees, compared to 11 the previous year. (Employees are measured at FTE (full-time equivalent).)

The earnings stated above come from return on investments and earnings from Enkotec A/S.

As of 31 December 2018, the foundation had a corporate-level balance sheet total of DKK 1,646.9 million, compared to DKK 1,615.2 million the previous year. Equity capital was DKK 1,161.1 million, compared to DKK 1,162.9 million the previous year.

Of the parent foundation’s assets, DKK 1,359.9 million are fixed financial assets, while DKK 143.1 million are fixed material assets. The fixed financial assets are the basis of the foundation’s future earning power.

Subsidiaries and properties

The Bikuben Foundation owns 100% of Enkotec A/S, which is headquartered in Skanderborg, and develops and manufactures high-quality machines for making high-precision nails for the global building industry. The company is a world-leader in its field, and has a balance sheet total of DKK 106.7 million and equity of DKK 67.6 million. The result in 2018 was DKK 45.7 million, compared to DKK 50.0 million in 2017.

Since 2013, the Bikuben Foundation has owned Høbbet A/S, which has two primary activity areas: farming and a research station, complete with accommodations and office facilities. The Høbbet farm comprises 110 hectares and is located adjacent to the foundation’s nature area, Svanninge Bjerge. The research station opened in 2016, and the University of Southern Denmark holds a long-term lease on market conditions. The university uses it for biological research and also uses for management conferences and other purposes.

Høbbet A/S has a balance sheet total of DKK 58.6 million and an equity of DKK 29.3 million. You can read annual reports for 2018, 2017, 2016, 2015 og 2014 here (in Danish only.)

BIFI A/S is a fully owned subsidiary founded in 2017. The company operates all the foundation’s investments in foreign private equity houses. The result for 2017 was DKK 17.4 million; the result for 2018 was DKK 23.1 million. The balance sheet total was DKK 325.7 million, compared to DKK 295.1 million the previous year. You can read annual reports for 2018 og 2017 here (in Danish only.)

Since 2013, the foundation has owned the property at no. 3–5, Otto Mønsteds Gade, Copenhagen V, which serves as the foundation’s headquarters. The first, second and third floors were renovated in 2013 and leased to seven different foundations. In 2015, the fourth and fifth floors were renovated, and since 1 January 2016, the property has been fully leased to 11 foundations.

Grants in 2018

Årets uddelinger er på 76,1 mio. kr. Der er ultimo 2018 henlagt 150 mio. kr. til senere uddelinger mod 120 mio. kr. året før.

Grant distributions totalled DKK 76.1 million in 2018. By the end of 2018, a sum of DKK 150 million had been set aside for future grants, compared to DKK 120 million the previous year.

For a more detailed specification of the grants distributed in 2018, we refer you to the list here

The Bikuben Foundation has its historical and conceptual roots in the Danish savings bank Sparekassen Bikuben, which was founded in 1857.

It was the first savings bank to operate both a financial institution and a mutual welfare society. It was founded on a social motivation, to respond to society’s need for improved welfare services for the growing working class of Copenhagen. Today, the Bikuben Foundation awards grants from the foundation’s returns and holdings, primarily to the arts and social purposes, based on the fundamental ideas that shaped the savings bank: social responsibility, innovation and self-help.

Over the years, mergers, take-overs and other developments have changed the framework and ownership of Sparekassen Bikuben. Several smaller charitable foundations have sprung from these activities and later merged with other, similar foundations. In 2010, in the most recent such merger, the BG Fonden merged with the Bikuben Fonden af 1989 (the Bikuben Foundation of 1989), the latter a commercially operated foundation that continues as the Bikuben Foundation.

The foundation’s funds

The Bikuben Foundation’s funds stem from the transition of Sparekassen Bikuben to a limited company in 1989. Today the Bikuben Foundation does not have any major individual holdings of bank shares. Instead, the foundation has a diverse investment portfolio based on a desire to maximise absolute returns to fund the foundation’s charitable purposes. Thus, investments include shares and credit bonds with due consideration for the foundation’s risk profile.

The active investment activity in listed securities is currently outsourced to two external investment managers: Danish Capital and SEB Asset Management with identical mandates.

The Bikuben Foundation also invests in companies via private equity investments through our fully owned subsidiary BIFI A/S.

Last, but not least, the Bikuben Foundation owns Enkotec A/S. The company, which is located in Skanderborg, develops and manufactures machines for the production of high-precision nails for the global building industry.

The consolidated accounts include the Bikuben Foundation’s activities and activities in Enkotec A/S, BIFI A/S and Høbbet A/S. Høbbet A/S farms the land adjacent to the Bikuben Foundation’s nature area Svanninge Bjerge.

Purpose

According to the Bikuben Foundation’s statutes, the foundation has the following purposes:

- to carry out financial activities through investments in shares or other participating interests and convertible debentures in commercial enterprises of every description;

- to provide grants, grant loans or in any other way encourage the operations of Danish enterprises for skilled trades and minor industrial businesses and, hence, contribute to the establishment of new enterprises within trade and light industry, as well as contributing to development projects within the framework of such enterprises; and

- to serve non-profit and charitable objects, subject to the board’s discretion, comprising such objects as it would have been natural for Bikuben to support, taking its history and identity into account.

Main activities

The Bikuben Foundation’s philanthropic work takes place in Denmark and, to some extent, in Greenland. The foundation seeks to create new opportunities for young people on the edge of society and helps artists and cultural institutions find new paths. In the social arena, the foundation focuses in particular on young people aged 13–30 facing complex social challenges. Within the arts, the foundation focuses mainly on the performing and visual arts. Every year the foundation hands out the Vision exhibition award, which supports the realisation of visionary visual arts exhibition formats. The Bikuben Foundation also hosts a series of debate salons focusing on issues, trends and developments within the performing and visual arts.

The Bikuben Foundation also recognises extraordinary achievements in the cultural or social fields via the Crown Prince Couple’s Awards.

The Bikuben Foundation owns and operates the nature area Svanninge Bjerge, which is used, among other purposes, as the setting for the foundation’s natured-based social initiative Natur til et godt liv.

Over the years, the Bikuben Foundation has provided funds to Kollegiefonden Bikuben and Bikubenfoundation New York, Inc. These funds have been used to construct and operate three student halls of residence in Denmark, in the cities of Odense, Aalborg and Copenhagen, and the operation of an Academic Guest House in New York City.

The board of the Bikuben Foundation

The board has six to eight members, elected by the board for two-year periods by simple majority. (NB! in 2015 the term was changed from four to two years). The chair is elected by the members of the board, who may also elect a vice chairman. Each member of the board can be re-elected four times. Members of the board can be elected up to and including the year in which they reach the age of 67, and they must retire no later than 1 May of the year in which they reach the age of 68. New board members are selected by means of an exhaustive recruitment process, initiated with impartial external assistance. The selection aims to ensure the necessary qualifications within management, investment, business operations, art and social issues.

Guided by the principles of foundation governance, the board oversees the overall management of the foundation. The board approves the strategies for foundation activities and investments. It determines the general principles for the foundation’s management, ensures through oversight that the management adheres to these principles and advises the management. The board conducts an annual evaluation of its own work.

The board of the Bikuben Foundation, which currently comprises six members, held four board meetings and one strategy meeting in 2018. In addition, the chairman and the vice chairman have taken part in meetings prior to each board meeting.

Each board member receives an annual basic fee of DKK 150,000 in remuneration for their service. The chairman receives three times the basic fee, and the vice chairman receives twice the basic fee.

Bikubenfondens direktion består af direktør Søren Kaare-Andersen.

Bikubenfondens direktør modtager et årligt vederlag på kr. 2.369.733, hvoraf kr. 2.227.549 vedrører Bikubenfonden og kr. 142.184 vedrører Kollegiefonden Bikuben.

Bikubenfonden har i 2018 beskæftiget gennemsnitligt 25 fuldtidsansatte medarbejdere, heraf er i gennemsnit 14 medarbejdere tilknyttet henholdsvis, projekter, Kollegiefonden Bikuben, Bikubenfoundation New York Inc. eller Høbbet A/S og BIFI A/S, og 52 fuldtidsansatte i Enkotec A/S.

You can read the full version of The Bikuben Foundation's annual report here (in Danish only.)

Read annual reports for 2017, 2016, 2015, 2014 og 2013 here (in Danish only.)

Read annual reports for BIFI A/S 2018 og 2017 here (in Danish only.)

Read annual reports for Høbbet A/S 2018, 2017, 2016, 2015 og 2014 here (in Danish only.)

Read annual reports for Kollegiefonden Bikubens 2018, 2017, 2016 og 2015 here (in Danish only.)

foundation governance

The Foundation embraces the Recommendations on

Foundation Governance